PI INDUSTRIES LTD.

Printed From: The Equity Desk

Category: Investment Ideas - Creating winning portfolios!

Forum Name: Emerging companies - Mid caps that can become large cap

Forum Discription: These are companies operating in growing markets having have certain niches or specific attributes like new sector plays. These are emerging multibaggers with high risks and high rewards.

URL: http://www.theequitydesk.com/forum/forum_posts.asp?TID=3310

Printed Date: 07/May/2025 at 4:28pm

Topic: PI INDUSTRIES LTD.

Posted By: hit2710

Subject: PI INDUSTRIES LTD.

Date Posted: 27/Jun/2011 at 2:07pm

|

PI INDUSTRIES BSE CODE 523642 EARLIER KNOWN AS PESTICIDES INDIA LTD, AND INCORPORATED IN 1947, THE COMPANY HAS TWO MAIN REVENUE STREAMS: 1. AGROCHEMICALS IN AGROCHEMICALS, THE COMPANY IS A LEADING PLAYER IN THE AGRO CHEM SPACE WITH A UNIQUE MODEL OF OUTLICENSING PATENTED MOLECULES FROM MNC COMPANIES AND LAUNCHING THEM IN INDIA. ITS FLAGSHIP BRAND IS NOMINEE GOLD WHICH HAS ATTAINED A LEADERSHIP STATUS IN THE RICE HERBICIDE SPACE. IN THIS SPACE THE COMPANY HAS STRONG DISTRIBUTION REACH WITH MORE THAN 1500 DISTRIBUTORS AND SELLS ITS PRODUCTS THROUGH 25000 RETAILERS. 2. CUSTOM SYNTHESIS THE COMPANY IS A PREFERRED PARTNER FOR MANY MNC COMPANIES TO DO CUSTOM SYNTHESIS OF THEIR PATENTED MOLECULES DUE TO THE STRENGTHS IN PROCESS RESEARCH AND MANUFACTURING. THE COMPANY ENTERS INTO THESE CONTRACTS ESPECIALLY DURING EARLY PART OF THE LIFE CYCLE MOLECULES WHERE THE MARGINS ARE HIGHER. CURRENTLY THE ORDER BOOK OF THE COMPANY IS CLOSE TO 300 MILLION USD TO BE EXECUTABLE OVER THE NEXT 3-4 YEARS. THIS DIVISION IS LIKELY TO BE THE GROWTH DRIVER OF THE COMPANY GOING FORWARD AND MARGINS HERE ARE ALSO BETTER. IN BOTH THE ABOVE SEGMENTS THE COMPANY HAS SHOWN ITSELF TO BE A RELIABLE TRUSTWORTHY PARTNER FOR ITS FOREIGN CLIENTS WITH A NO CONFLICT BUSINESS MODEL. FINANCIALS: THE EQUITY CAPITAL IS AROUND 12 CRORES WITH 1.2 CR SHARES OF RS 10 EACH OUTSTANDING . CURRENT MARKET CAP IS AROUND 900 CRORES. PROMTERS HOLDING IS AROUND 63% WITH NO PLEDGING. STANCHART PE HOLDS AROUND 15% WITH ROWANHILL INVESTMENTS HOLDING 9%. ALONG WITH OTHER HNI AND ALL THE ABOVE HOLDING THE TOTAL HOLDING COMES TO AROUND 90% DUE TO WHICH THE FLOATING STOCK IS LIMITED. TOTAL DEBT IS AROUND 248 CRORES AS ON MARCH 11. CASH ON HAND IS AROUND 50 CRORES. ROE FOR FY 11 IS AROUND 35.

THE COMPANY ALSO HAD A POLYMER DIVISION WHICH WAS A LOW MARGIN BUSINESS AND THE COMPANY SOLD IT OFF TO A FRENCH COMPANY RHODIA SA FOR A CONSIDERATION OF AROUND 70 CRORES. THIS MONEY WOULD BE UTILISED TO EXPAND THE EXISTING BUSINESSES. THE COMPANY HAS ACQUIRED LAND IN STERLING SEZ IN JAMBUSAR NEAR BARODA AND WILL DEVELOP ENHANCED CAPACITIES FOR CUSTOM MANUFACTURING TO CATER TO THE EXISTING AND EXPECTED ORDER BOOK.

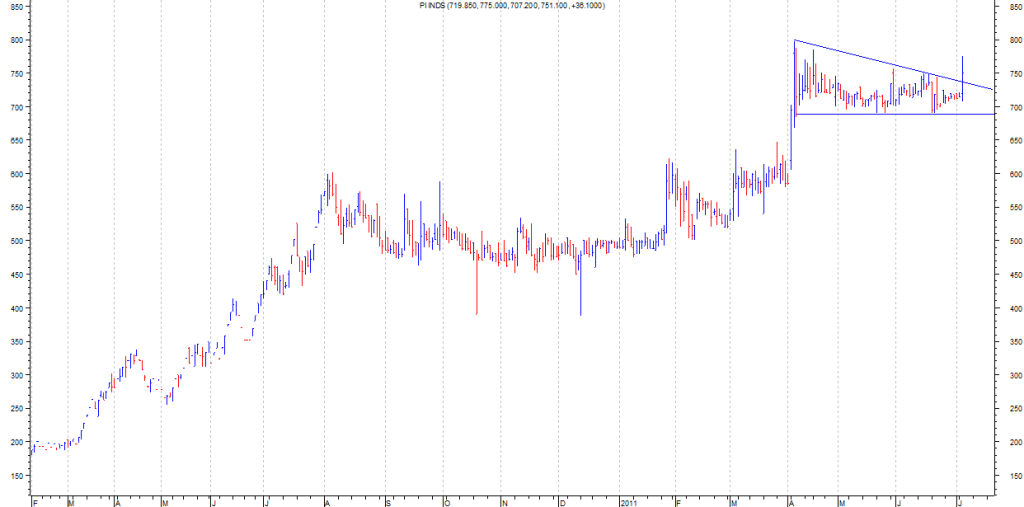

AS PER THE ORDER BOOK STATUS AND SOME RESEARCH REPORTS, THE COMPANY IS EXPECTED TO SHOW GOOD PROFIT GROWTH OF AROUND 35-40% CAGR FOR THE NEXT 2-3 YEARS. AT CURRENT MARKET PRICE OF AROUND 715, THE STOCK IS AVAILABLE AT A PE OF AROUND 10 BASED ON EXPECTED EPS OF 70 FOR FY 12. LOOKING AT THE GROWTH PROSPECTS WITH THE COMPANY ENTERING HIGHER GROWTH TRAJECTORY , THIS COULD BE CONSIDERED FOR INVESTMENT WITH A 3-5 YEAR VIEW. TECHNICALS: AFTER POSTING A RECENT HIGH OF 797 IN APRIL 11, THE STOCK IS CONSOLIDATING IN THE RANGE OF AROUND 690 TO 750 CURRENTLY. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Replies:

Posted By: rapidriser

Date Posted: 27/Jun/2011 at 3:01pm

|

Hitbhai! Agree with you that the stock looks interesting. High food prices around the world are providing a favourable environment for cos producing agrochemicals. I was still studying the stock before taking a position. Now your reco will send the price of this stock higher and increase my cost per share.  ------------- When all else is lost, the future still remains. - Christian Nestell Bovée |

Posted By: hit2710

Date Posted: 05/Jul/2011 at 6:51pm

After a prolonged consolidation PI seems to be breaking out from sideways movements.

------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: Shadofax

Date Posted: 05/Jul/2011 at 10:53am

|

Hitbhai ... it is the effect of your analysis ;) ------------- $ |

Posted By: rapidriser

Date Posted: 06/Jul/2011 at 2:54pm

|

Hitbhai's recos are always big hits.  ------------- When all else is lost, the future still remains. - Christian Nestell Bovée |

Posted By: hit2710

Date Posted: 06/Jul/2011 at 7:12pm

I dont think anyone's analysis can have any effect on the stock price. Most of it is to do with fundamentals and market perceptions. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: Jaishrikrishna

Date Posted: 06/Jul/2011 at 7:28pm

|

The point is, how many of them bought it, when hit bhai put this up on ted. Only when the price went up we start noticing his picks, He has a conviction and there should not be a doubt in once mind. ------------- Don't Buy and Hold, Buy and Homework / Fish see the bait,but not the hook; Men see the profit, but not the peril. |

Posted By: prudentinvestor

Date Posted: 06/Jul/2011 at 7:31pm

|

Hi Hiteshji, I bought 1/4th deemed amount for PI Industries at 696. Kindly suggest what will be good levels to buy more. ------------- "All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don’t work out..” - Peter Lynch |

Posted By: shashikapoorin

Date Posted: 06/Jul/2011 at 7:46pm

|

Jai krishna j kya kare jee tabhi lalchata ha jab stock upper jata ha...... Aur abhi chalti train mein baithna hum bache log sikh rahe hain....  ------------- We dont hv 2 be smarter then others v need 2 be more disciplined then others |

Posted By: Jaishrikrishna

Date Posted: 06/Jul/2011 at 7:49pm

------------- Don't Buy and Hold, Buy and Homework / Fish see the bait,but not the hook; Men see the profit, but not the peril. |

Posted By: hit2710

Date Posted: 06/Jul/2011 at 7:49pm

Exact levels are for you to decide according to risk profile. Maybe declines to 650-670 can be used to add more. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: shashikapoorin

Date Posted: 06/Jul/2011 at 7:59pm

|

Hitesh ji and jaikrishna ji we all want to learn technical analysis so please start a thread where both of you will teach us technical analysis from basics.I dont find any thread where technical analysis is discussed how we do it. ------------- We dont hv 2 be smarter then others v need 2 be more disciplined then others |

Posted By: kmp_saij

Date Posted: 06/Jul/2011 at 9:41pm

Basantji once said: you can borrow or even steal ideas from someone, but you can not get conviction with it you have to build conviction yourself.

This is so true. ------------- Own whatever’s feared, shun whatever’s beloved. |

Posted By: Jaishrikrishna

Date Posted: 06/Jul/2011 at 10:00am

|

KMp thats what i meant,basically the ideas are always borrowed and stolen, It's up to you how you work on it. Once u have an idea, start digging into it. and if you feel comfortable go ahead. ------------- Don't Buy and Hold, Buy and Homework / Fish see the bait,but not the hook; Men see the profit, but not the peril. |

Posted By: Ravenrage

Date Posted: 26/Jul/2011 at 6:56pm

| 38 rupees earnings for the quarter ! 1500 soon !! |

Posted By: commnman

Date Posted: 26/Jul/2011 at 7:08pm

|

One of the Navaratna's on Hit Ji's cap!

Q1/Fy-12 numbers out with a bang!!! Total Income up 58.7% to 206.79 Cr from 130.28 Cr. EBIDTA more than doubled to 43.15 Cr from 19.47 Cr. Adj. Net Profit (before exceptions) up 80% to 17.61 Cr from 9.77 Cr. EBIDTA margin is 20.9% V/s 14.9% (JQ-10) and 18.8% (MQ-11) Adj. NET Pr margin is 8.5% V/s 7.5% (JQ-10) and 9.6% (MQ-11) Raw material costs as a %ge to Income is 53.2% V/s 56.5% (JQ-10) and 57.7% (MQ-11) Employee costs to Income ratio is 8.1% v/s 9.7% (JQ-10) and 7.3% (MQ-11) Other expenses to Income ratio is 17.9% v/s 18.9% (JQ-10) and 16.3% (MQ-11) Tax Rate is 25.4% v/s 20.9% (JQ-10) and 32.6% (MQ-11) Note: Net profit after exceptional item (Sale of polymer compound business for 30.34 Cr) is 47.95 Cr. Hence very high EPS. - ------------- main toh aam aadmi hun... jo sunta hoon wohi sach maanta hoon |

Posted By: hit2710

Date Posted: 26/Jul/2011 at 7:13pm

|

JUST TO ADD TO COMMNMAN'S EFFORTS. PI INDS Q1 FY 12 RESULTS

*NET PROFIT FOR THE QUARTER IS 48 CRORES (WHICH INCLUDES EXTRA ORDINARY GAIN OF 30 CRORES – ADJUSTED FOR TAX PAID AT 30% THIS COMES TO AROUND 21 CRORES) AND HENCE NET PROFIT IS AROUND 27 CRORES (ADJUSTED FOR EXTRAORDINARY) AGAINST 9.76 CRORES IN Q1 FY 11. CURRENT MARKET CAP IS AROUND 1156 CRORES AND LOOKING AT THE FIRST QUARTER PERFORMANCE THE COMPANY MIGHT DO AROUND 100 CRORES OF NET PROFIT FOR FY 12. EFFECTIVELY THE STOCK IS AVAILABLE AT 11-12 TIMES FY 12 EARNINGS EVEN AFTER THE RECENT RUN UP. LOOKS LIKE THIS COULD GO THE AVT WAY. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: shadows

Date Posted: 26/Jul/2011 at 9:00pm

|

want to add a little more

PI ind. last years performance on Quarterly basis Q1 Q2 Q3 Q4 9.7 18.7 15.2 20.3 [Net profit in crores] Q1FY12 numbers are out and i wish it repeats FY11 ....

hit bhai do you find anywhere FY13 guidance |

Posted By: tejas.k

Date Posted: 26/Jul/2011 at 9:05pm

|

hit ji could you tell what AVT is ?

|

Posted By: Ravenrage

Date Posted: 26/Jul/2011 at 9:06pm

|

AVT = AVT Natural

http://www.bseindia.com/bseplus/StockReach/AdvanceStockReach.aspx?scripcode=519105 - Link |

Posted By: Jaishrikrishna

Date Posted: 26/Jul/2011 at 9:19pm

|

Rather look at this Link: http://in.finance.yahoo.com/q/bc?s=AVTNPL.NS&t=3m&l=on&z=l&q=b&c= - 3 MONTH CHART ------------- Don't Buy and Hold, Buy and Homework / Fish see the bait,but not the hook; Men see the profit, but not the peril. |

Posted By: tejas.k

Date Posted: 26/Jul/2011 at 10:05pm

|

thanks jaikrishna ji. hit ji ,when u say it could go the avt way, do you mean price movement or something else? |

Posted By: hit2710

Date Posted: 26/Jul/2011 at 10:45pm

I mentioned earlier also that for first quarter adjusted net profit is around 27 crores.(this is a rough estimate by deducting the extraordinary and tax thereon) So extrapolating it for four quarters gives net profit for full yr in excess of 100 crores. Last yr net profit was 65 crores. So for fy 12 there could be more than 50% growth. Now as earlier mentioned in the thread the second half of the year for this company is usually better than first half. So there could be an upside risk to above assumption. current market cap is around 1156 crores if you consider expanded equity of around 12.5 crores and cmp of 930 or so. So on a market cap of 1156 if the company can post net profit of above 100 crores it is available at a forward PE of just 11-12 and for a company with excellent growth visibility for next 3 years atleast based on its orderbook for custom synthesis business, re rating is bound to occur. Projecting an optimistic PE of 20 for this stock, the market cap could reach more than 2000 crores which means stock could roughly double from here with the rerating and earnings growth. Projections for fy 13-- edelweiss in one of its reports projects eps for fy 13 at 104. If that is achieved (looks possible) then price can only be guessed. And since floating stock is low the scarcity premium would come into play and could give dizzy heights to stock price. All the above projections are made by a part owner of the business who happens to be very optimistic and hence you are requested to do your own homework and decide. Ideal time could be a bad quarter but that is when the investor confidence is shaken most and hence people are scared to buy. To me this looks like a candiate for PE rerating with consistent EPS growth which puts it in a very sweet spot. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: tejas.k

Date Posted: 26/Jul/2011 at 11:12pm

|

thanks hit ji. makes sense. however if you look at the sector (fertilizers and stuff), the P/E is very low. even cormandal international is at 13.. i would love to hear you views on this. because they say, sectoral p/e is also very important. i am not an expert like you. so i want to know you your views. in fact i have the same concern with vst tillers. (although in a different sector) |

Posted By: hit2710

Date Posted: 26/Jul/2011 at 12:04pm

PI Inds is very far away from fertiliser sector. To begin with there is no govt regulatory control in the space in which PI operates. The closest similarity in Indian markets I found for PI is Divi's labs(esp for the custom synthesis business which is going to be the growth and margin driver for PI ). You can compare valuations with Divi's labs if at all you want to compare. If I recall correctly Divis trades at 25 times trailing earnings. PI is a company with two main divisions -- agrichem and custom synthesis. To understand the things with a better perspective you can go through the Annual Reports available at company website or on bse. I have a physical copy and just a few days back went through and the management has done a great job of explaining their business and prospects of both businesses they operate in. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: bobdylan

Date Posted: 26/Jul/2011 at 7:30am

|

Dear Hitji,

maybe rallis,bayer, dhanuka could be peers in the agrichem space.Went thru the quarterly results.There is a large increase in stocks/inventory.A large increase in the inventory in the march quarter was countered by the management that they were stocking up before the may season .Would they have to take more debt to complete their new plant.The free cash flows would be really kicking in only in FY13,if everything goes well and the plant is operational.Is there anyway to know if they have resolved their working capital issues.In the agrichem space do they have some standout products or will the CRAMS business be the future.

|

Posted By: shadows

Date Posted: 26/Jul/2011 at 8:03am

|

hitbhai PI Industries on 23/4/2011 has made allotment of 3,11,658 equity shares of Rs 10 each to Standard Chartered Private Equity(Mauritius)and Standard Chartered Private Equity(Mauritius)II upon conversion of 8,10,000 compulsorely convertible preference shares of Rs 100 each held by them."

what does this mean at 100 rs.? is this has anything to do with cmp@930+

thanks |

Posted By: Jaishrikrishna

Date Posted: 26/Jul/2011 at 8:26am

|

Everybody needs ready made answers,though Hit bhai will give you that, but still if one really needs to build his conviction, I would humbly request to kindly go through the Annual report and Management Concall, There all your queries will be answered. ------------- Don't Buy and Hold, Buy and Homework / Fish see the bait,but not the hook; Men see the profit, but not the peril. |

Posted By: manishdave

Date Posted: 26/Jul/2011 at 9:50am

| PI Industries on fire!! |

Posted By: shadows

Date Posted: 26/Jul/2011 at 10:07am

|

managed to buy some at upper circuit besides few at 900.

august 19 record date for stock split |

Posted By: bitu1978

Date Posted: 27/Jul/2011 at 3:21pm

| Another Hit from Hiteshbhai |

Posted By: ali1

Date Posted: 27/Jul/2011 at 5:17pm

| this is first time that any share i hold hit upper circuit. there may be 2 or 3 baggers but 20% in a day is wonderful. |

Posted By: hit2710

Date Posted: 27/Jul/2011 at 8:33pm

Idea is borrowed. Write up and conviction is mine.  ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: shadows

Date Posted: 27/Jul/2011 at 8:51pm

|

I wonder that after the present gigantic run of AVT from 80+ to 430+ in no time it's P/B is 5.6

where as PI industries P/B is already near 7. i wonder if any juice left in PI from current levels

still i want 22/7 industries to reach 2217 rs at least in 18 months

|

Posted By: Jaishrikrishna

Date Posted: 27/Jul/2011 at 9:21pm

Its the market cap you have to look, with respect to their peers, And with your theory have you looked at hawkins P/B? ------------- Don't Buy and Hold, Buy and Homework / Fish see the bait,but not the hook; Men see the profit, but not the peril. |

Posted By: patra04

Date Posted: 27/Jul/2011 at 9:42pm

|

Missed this bus.

Was reading and researching and it just ran away

As Buffett would say, sat there sucking my thumb.

Regards,

Rahul ------------- An investment in knowledge pays the best interest. |

Posted By: Noodle

Date Posted: 27/Jul/2011 at 9:57pm

As Hitbhai rightly said, EPS is around 70 and P/E if rerated to 20 will give a price of around 1400. So yes there is steam left in this. Looks like Teddies buying like crazy. |

Posted By: tejas.k

Date Posted: 27/Jul/2011 at 10:13pm

Whatever. But we ( at least I) borrow ideas from hit ji. In my case, its vst tillers, ajanta pharma and mayur. PI was actually in watch list. But it kept going up and i didnt buy it since it was near 52 week high (;-. another lesson learnt.

|

Posted By: hit2710

Date Posted: 27/Jul/2011 at 10:32pm

Actually I myself too suffered from this problem earlier. But then thinking it through, I felt that stocks dont post all time highs for nothing. There is either froth or some specific fundamental reason for the stocks posting these highs. And if one can discount the froth factor, and fundamentals do seem to be changing for the better, I dont hesitate taking a position. Same logic applies in the reverse. Stocks dont post all time lows for nothing. But there also sometimes there might be opportunities where market perception might be flawed and one gets excellent entry points. This happens due to some policy decision (read gold loan companies -muthoot, manappuram )which is supposed to affect companies but if the company can find ways and means to counter it, then one can get good stocks cheap. Another setup is when the whole sector is being derated and therein sometimes great companies are also butchered without rhyme or reason. e.g infra sector. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: shashikapoorin

Date Posted: 27/Jul/2011 at 10:42pm

hit sir thanks for the gyaan  ------------- We dont hv 2 be smarter then others v need 2 be more disciplined then others |

Posted By: Jaishrikrishna

Date Posted: 27/Jul/2011 at 11:17pm

|

Another thing which is to be noted , Don't know how many people took into consideration is the current debt level which has gone significantly down past Qtr. Its down by 46%, That's what a lot of people were worried about.

Can expect another circuit, i guess  ------------- Don't Buy and Hold, Buy and Homework / Fish see the bait,but not the hook; Men see the profit, but not the peril. |

Posted By: Jaishrikrishna

Date Posted: 28/Jul/2011 at 1:27pm

|

Interview with Chairman and CMD on ET NOW, He was speaking on the quarterly results. Confident of achieving Net Profit of 110 Crs for F.Y.12.

http://economictimes.indiatimes.com/et-now/results/pi-ind-hits-all-time-high-as-q1-bottom-line-soars/videoshow/9394103.cms - Here is the LINK ------------- Don't Buy and Hold, Buy and Homework / Fish see the bait,but not the hook; Men see the profit, but not the peril. |

Posted By: patra04

Date Posted: 28/Jul/2011 at 8:37pm

|

Financial Highlights for the quarter ended 30th June, 2011 (Compared to Q1 FY11) • Net Revenue at Rs. 2064 million, up by 59% Even if we exclude the exceptional item the numbers still look excellent ! Another highlight which Jaishrikrishaji pointed earlier: Managed to add some today to the portfolio :-) Regards, ------------- An investment in knowledge pays the best interest. |

Posted By: hit2710

Date Posted: 02/Aug/2011 at 2:34pm

|

MANAGEMENT COMMENTARY POST Q1 FY 12 CONCALL

AGRI INPUT BUSINESS GREW 84% Y-ON-Y TO STAND AT 125 CRORES CSM BUSINESS GREW 83% Y-ON-Y TO 62.1 CR. COMPANY BAGGED ANOTHER ORDER FOR AROUND 40 MILLION USD IN THE QUARTER. SO THE ORDER BOOK OF THE COMPANY AS ON JUNE 11 STANDS AT 1500 CRORES. EBIDTA FOR QUARTER WAS 43.2 CR WITH AGRI BUSINESS EBIDTA MARGIN AT 19% WHILE CSM BUSINESS EBIDTA MARGIN AT 22-23%. MANAGEMENT HAD ALREADY GUIDED FOR 40% SALES GROWTH FOR FY 12 BUT IN VIEW OF Q1 FY 12 NUMBERS THEY ARE GOING TO WAIT FOR Q2 FY 12 NUMBERS BEFORE UPPING THE GUIDANCE.FIGURES TILL JULY HAVE BEEN ENCOURAGING IN THIS ASPECT. BALANCE SHEET HAS IMPROVED WITH DEBT REDUCING FROM 248 CRORES AS ON MAR 11 TO 133 CR AS ON JUNE 11. DEBTORS LEVEL IS AT 146 CR VS 177 CRORES AS ON MARCH 11. INVENTORY LEVEL IS AT 185 CR VS 147 CR AS ON MARCH 11. PLANNED CAPEX FOR NEXT 2 YRS IS 125 CR WITH MAIN FOCUS ON COMMISSIONING OF MULTI PRODUCT CSM PLANT AT JAMBUSAR STERLING SEZ. WORK HAS BEGUN AND EXPECTED TO BE COMPLETED BY DEC 11. COMPANY PLANS TO LAUNCH TWO NEW PRODUCTS IN AGRI CHEM SPACE THIS YEAR. IT HAS A PIPELINE OF 7-8 NEW MOLECULES TO BE LAUNCHED IN NEXT 3 YEARS. SONY PI RESEARCH CENTRE IS PROGRESSING AS PER SCHEDULE. (ANY POSITIVE SURPRISES IN TERMS OF NEW PRODUCT DISCOVERY CAN GIVE GOOD UPSIDES. NONE OF THIS IS CURRENTLY FACTORED INTO THE PROJECTIONS.) ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: hit2710

Date Posted: 02/Aug/2011 at 7:21pm

PI INDUSTRIES DAILY CHART SHOWS A CRUCIAL RISING GAP BETWEEN 970-989 LEVELS. THIS IS AN AREA OF SUPPORT TO LOOK FORWARD TO. IF STOCK CLOSES BELOW GAP AREA FOR A COUPLE OF SESSIONS THEN WE MIGHT BE IN FOR PROLONGED CONSOLIDATION. OTHERWISE UPTREND MAY BE INTACT. ALSO NOTICE THE PROLONGED CONSOLIDATION FOR MORE THAN THREE MONTHS PRIOR TO THE BREAKOUT WHICH LENT STRENGTH TO THE BREAKOUT.

------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: Jaishrikrishna

Date Posted: 02/Aug/2011 at 8:42pm

|

More of a bullish flag formation. ------------- Don't Buy and Hold, Buy and Homework / Fish see the bait,but not the hook; Men see the profit, but not the peril. |

Posted By: hit2710

Date Posted: 08/Aug/2011 at 2:06pm

|

After going through the fy 11 AR, management concall transcripts for fy 11 and some details of q1 fy 12 results, I have tried my hand at some projections for PI Inds.

financial year eps pe price fy 11 57 11-13 600-700 fy 12 75-90 12-15 900-1350 fy 13 120-130 15-20 1800-2500 Picture for fy 12 will be slightly more clearer after q2 fy 12 as the second quarter is likely to be the best quarter. Some key monitorables include: 1. Progress of monsoon 2. Starting of operations at new facility in Sterling SEZ 3. Overall condition of general markets 4. Any progress/new development coming out of Sony-PI joint venture. views invited. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: Jaishrikrishna

Date Posted: 08/Aug/2011 at 2:26pm

Sony Co. JAPAN..is one of the best and widely known corporations in the world, This J.V will be real fruitful, if one person has a longer view, irrespective of the market conditions. I myself had a privilege of meeting some officials of Sumitomo Corp. Japan, in Nariman Point,Mumbai. while i was working on a project of Mosquito Mats and coils. The Japanese are thoroughly professional people and do every due diligence possible before entering any joint venture or for that matter any simple paper work, these guys go deep into the roots before taking any desicion. What's interesting here is leaving beside the leaders they choose this management which in itself shows the credibility. Take my words only as pinch of salt cause i may be biased here, as i am invested.  ------------- Don't Buy and Hold, Buy and Homework / Fish see the bait,but not the hook; Men see the profit, but not the peril. |

Posted By: kailasp4u

Date Posted: 08/Aug/2011 at 9:08pm

High-Low-Close on 5th August 2011 == 986-930-956 High-Low-Close on 8th August 2011 == 979-905-948.55 Is it technical break-down leading to long consolidation. Although fundamentals dont change in 2 days, liquidity and sentiments may! ------------- knp |

Posted By: anthro

Date Posted: 11/Aug/2011 at 2:31pm

|

http://www.indiankanoon.org/doc/979870/ -

http://www.indiankanoon.org/doc/979870/

Does not past promoter actions give sufficient indication of lack of promoter integrity.Above Sebi order on PI industries of 30th August 2002 speaks about how promoters wanted to buy out 949 public shareholders at Rs.17 per share when book value was Rs.109 per share citing among other things reasons like poor industry prospects.

|

Posted By: Jaishrikrishna

Date Posted: 12/Aug/2011 at 7:16pm

The company has got noticed by an fii (J P MORGAN SEC LTD A/C COPTHALL MAURITIUS INVEST LTD) , who has just purchased 165541 tickets today.  ------------- Don't Buy and Hold, Buy and Homework / Fish see the bait,but not the hook; Men see the profit, but not the peril. |

Posted By: manish_okhade

Date Posted: 12/Aug/2011 at 8:50pm

| Hit Bhai is our small cap Fund Mgr, pata nahi kaha kahan se GEM search karke laate hain :-). |

Posted By: Supermanglide

Date Posted: 15/Aug/2011 at 8:14am

|

Hitbhai's recos are usually huge hits.

------------- http://www.buyguccishop.com/ - Cheap Gucci Shoes http://www.buyguccishop.com/gucci-boots-c-59.html/ - Cheap Gucci Boots |

Posted By: Noodle

Date Posted: 16/Aug/2011 at 11:59am

| Kya hua aaj? 50% down. Operator's loading on? or MF to buy at lower prices? Hitbhai, help. |

Posted By: shontou

Date Posted: 17/Aug/2011 at 12:01pm

|

FACE VALUE SPLIT FROM RS.10/- TO RS.5/-

For God's sake do not panic! ------------- Every day, self-proclaimed stock market "experts" tell us why the market just went up or down, as if they really knew. So where were they yesterday? |

Posted By: hit2710

Date Posted: 17/Aug/2011 at 1:32pm

Split from Rs 10 to Rs 5 effected from today. There seem to be unusually high vols here. No need to panic. Just multiply the price by 2.

In one of my demat accounts, the no of shares have doubled while in other they have yet to be adjusted. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: prudentinvestor

Date Posted: 17/Aug/2011 at 5:45pm

You will receive equal numbers of existing shares you are holding, So your X shares become 2X, and at the current price the total value of your holdings remain same. ------------- "All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don’t work out..” - Peter Lynch |

Posted By: Ravenrage

Date Posted: 21/Aug/2011 at 9:36am

Damn damn damn , how i wish I could strangle this Tulsian .           ------------- Risk does not reside in price changes, but in miscalculations of intrinsic value . |

Posted By: Jaishrikrishna

Date Posted: 21/Aug/2011 at 10:09am

------------- Don't Buy and Hold, Buy and Homework / Fish see the bait,but not the hook; Men see the profit, but not the peril. |

Posted By: hit2710

Date Posted: 21/Aug/2011 at 10:23am

Kyun bhai?? Usne aisa kya kar dala?? ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: Ravenrage

Date Posted: 21/Aug/2011 at 10:30am

|

How can this joker see value in the stock . Is that chap around here ? Seems a certainty . I hate when Tulsian's picks matches with any of the stocks in my portfolio . This one is going to be in the hand of manipulators .

As serious question in his style : Is the Tulsian around on the TED ? ------------- Risk does not reside in price changes, but in miscalculations of intrinsic value . |

Posted By: hit2710

Date Posted: 21/Aug/2011 at 10:46am

I still dont get the drift of the conversation. Has tulsian recommended this stock?? Or does he accuse this counter of being in the hands of operators? ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: Vijkm

Date Posted: 21/Aug/2011 at 10:57am

|

Hitjee, i think raven was referring to below info

Tulsian's multibaggers: See value in PI Ind & GSFC http://www.moneycontrol.com/news/market-outlook/tulsian39s-multibaggers-see-valuepi-indgsfc_578527.html ------------- Vijay |

Posted By: hit2710

Date Posted: 21/Aug/2011 at 11:03am

thanks. I saw him talking about gsfc but guess missed the PI part.  ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: Ravenrage

Date Posted: 21/Aug/2011 at 11:16am

|

Ya , was referring to that . ------------- Risk does not reside in price changes, but in miscalculations of intrinsic value . |

Posted By: Jaishrikrishna

Date Posted: 22/Aug/2011 at 12:12pm

That is out of the question, cause he hasn't mentioned the CSM business at all, in any specific details. ------------- Don't Buy and Hold, Buy and Homework / Fish see the bait,but not the hook; Men see the profit, but not the peril. |

Posted By: arunshah2k

Date Posted: 22/Aug/2011 at 12:55pm

Not sure if this is known, but Sequoia Capital took stake around 1.82% in PI Industries via block deal on the day of split. |

Posted By: hit2710

Date Posted: 22/Aug/2011 at 1:02pm

Yes its through their investment arm ironwood investments. This kind of things are likely to continue bcos another big investor called Rowanhill (which sold stake while sequoia bought) is gradually getting out and it still might have another 3-4% to offload. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: Ravenrage

Date Posted: 22/Aug/2011 at 1:22pm

Udayan must have given him less time . ------------- Risk does not reside in price changes, but in miscalculations of intrinsic value . |

Posted By: rdyn

Date Posted: 22/Aug/2011 at 5:34pm

|

Tulsian's multibaggers: See value in PI Ind & GSFC

Published on Mon, Aug 22, 2011 at 08:35 | Source : CNBC-TV18 Updated at Mon, Aug 22, 2011 at 11:09 In an exclusive interview with CNBC-TV18's Udayan Mukherjee and Mitali Mukherjee, SP Tulsian of sptulsian.com says the good monsoon this year is opening opportunities to reap from agriculture stocks. His multibagger picks today include PI Industries and GSFC. "I am very positive on agriculture stocks with a one year view," he says. He sees tremendous value in PI Industries for view of 12-month perspective and sets a price target of Rs 750, while expects GSFC to have a price target of Rs 500 in a year. Below is an edited transcript of Tulisan’s comments on CNBC-TV18. Also watch the accompanying video. On PI Industries PI Industries is into agro-chemicals, specialty chemicals and agricultural inputs like seeds. The company’s performance has been good for FY11. The company has recently gone for a stock split. They have three plants, one each in Udaipur, Ankleshwar, and in Jammu. In the Q1 results of FY12, the company had included an odd gain worth Rs 30 crore through the sale of polymer compounding business because it was unrelated to their core business and hence, they knocked it off. They posted a PAT of Rs 48 crore for first quarter on a lower equity base of Rs 12.5 crore. However, traditionally Q2,Q3 and Q4 have been always the better quarters for the company. And the company has been steadily growing its research and development (R&D) arm. It has now set up an R&D center in collaboration with Sony Corporation and they will be ramping it up over the next couple of years. They have recently entered into a distribution agreement with an MNC as well for distribution of agro chemicals. Hence, taking all these into consideration, the company is likely to post an EPS of Rs 42 to Rs 44 for FY12 on a recently reduced face value of Rs 5. I see tremendous value because of the positive view on the agri inputs company and specifically, on this stock if somebody can keep a view of about one year, they should be able to see a price target of Rs 750. http://www.moneycontrol.com/news/market-outlook/tulsians-multibaggers-see-valuepi-indgsfc_578527.html%20 - http://www.moneycontrol.com/news/market-outlook/tulsians-multibaggers-see-valuepi-indgsfc_578527.html ------------- My aim is to read each and every post on TED! |

Posted By: patra04

Date Posted: 22/Aug/2011 at 7:26pm

|

Love the guy or hate him, he comes out with multibagger ideas almost every week (although its a different matter if the stocks he recommends really turn out multibaggers or duds ------------- An investment in knowledge pays the best interest. |

Posted By: FutureBull

Date Posted: 22/Aug/2011 at 10:05pm

every week? I see him every day. He tries taking calls from CNBC while going home. So this is called uninterrupted service  ------------- ‘The market always does what it’s supposed to — BUT NEVER WHEN’. |

Posted By: shontou

Date Posted: 22/Aug/2011 at 10:33pm

|

Tulsian's thought process - search for BSE/NSE top gainers and recommend them next day. If all else fails recommend Reliance Industries.

SP Tulsian's universal solution to all of mankind’s problems is to “Buy Reliance Because Reliance Is A Good Company” ------------- Every day, self-proclaimed stock market "experts" tell us why the market just went up or down, as if they really knew. So where were they yesterday? |

Posted By: kailasp4u

Date Posted: 22/Aug/2011 at 10:51pm

|

For more details about Tulsian's research process, refer to website http://www.rakeshjhunjhunwala.in/search?q=tulsian - http://www.rakeshjhunjhunwala.in/search?q=tulsian ------------- knp |

Posted By: patra04

Date Posted: 22/Aug/2011 at 11:57pm

|

LOL ! That website is so surreal.

Hats off to the creator. Thank you kailasji for sharing.

Regards,

Rahul ------------- An investment in knowledge pays the best interest. |

Posted By: hit2710

Date Posted: 22/Aug/2011 at 11:58pm

its real funny.  ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: rdyn

Date Posted: 22/Aug/2011 at 12:01pm

Hahaha :D Kailashji...great share ..I cudnt stop laughing

------------- My aim is to read each and every post on TED! |

Posted By: Ravenrage

Date Posted: 22/Aug/2011 at 12:18pm

|

http://www.theequitydesk.com/forum/forum_posts.asp?TID=1688&PN=276

Still don't know , why the 1st post on that page was not approved ! ------------- Risk does not reside in price changes, but in miscalculations of intrinsic value . |

Posted By: SimpleInv

Date Posted: 22/Aug/2011 at 4:09am

Yes, He is funny. FYI, he is on twitter. He used to be the best in the initial days of twitter. |

Posted By: Ansh

Date Posted: 22/Aug/2011 at 4:26am

Great post, very funny indeed. |

Posted By: kailasp4u

Date Posted: 22/Aug/2011 at 10:00am

|

I also dont know creator of rakeshjhunjhunwala.in but I have been reading it for long time. You can read all posts on different matters (Suresh Kalmadi, Digvijay Singh, Arnab Goswami and all TV/Public personalities). These are only for fun and parody. The content is continuously updated on fresh issues! ------------- knp |

Posted By: rinkumalpani

Date Posted: 23/Aug/2011 at 5:32pm

Well, The way some of the smallcaps jump up after say somebody good at TED finds them and mentions them on TED and then after a couple of days the stocks are mentioned by somebody on the TV, sure makes me feel either some analyst just copy our senior teddies or some manipulators/operators might be trying to take advantage of this free advertisement. Or is it that am simply bein paranoid..

NEvertheless, TED is a gud learning place and i believe the more people use this place as a learning school, the better it serves the purpose. |

Posted By: bobdylan

Date Posted: 24/Aug/2011 at 8:36pm

|

he is belting out multibaggers on a daily basis ,todays picks are NMDC,arvind and bajaj finance,these are not TED favorites(so maybe he is not part of TED) ! |

Posted By: bsk0404

Date Posted: 06/Sep/2011 at 6:25pm

|

Its surprise, I was scared when GSFC was mentioned as multibagger. surprisingly it made new high today..... Any how any one is following GSFC here?? Disc. I hold GSFC since long time. ------------- There are only 2 tragedies in market 1st buying a good stock at wrong price 2n buying wrong stock at any price. |

Posted By: manish962

Date Posted: 06/Sep/2011 at 10:29am

| GSFC has got new MD and he is a dynamic person. They have few projects in the pipeline and he is efficient enough to execute it well. Also they had some raw material shortage during past few qtrs due to unrest in tunisia which was suppose to be streamlined within short time. That will boost the fertilizers output. Also the nutrient based subsidy is going to help to boost profits from this segment. The monsoon is normal in the western region where it markets its fert products. However this year they may not enjoy the higher margins in capro & melamine. I expect the eps to be in the range of 75-80. Dicl. I hold GSFC. |

Posted By: shontou

Date Posted: 21/Sep/2011 at 9:14am

|

PI's R&D facility receives GLP Certification

http://www.bseindia.com/xml-data/corpfiling/AttachLive/PI_Industries_Ltd_210911.pdf - http://www.bseindia.com/xml-data/corpfiling/AttachLive/PI_Industries_Ltd_210911.pdf ------------- Every day, self-proclaimed stock market "experts" tell us why the market just went up or down, as if they really knew. So where were they yesterday? |

Posted By: Koti_gunda

Date Posted: 22/Sep/2011 at 7:50pm

|

The sharp currency movement might show some impact on the Custom Synthesis margins. As the custom synthesis business is mainly export oriented the currency movement impact will be felt atleast in the short term.

Hit ji, correct me if i am wrong.

|

Posted By: hit2710

Date Posted: 22/Sep/2011 at 7:59pm

Raw material costs are pass through in nature in custom synthesis business although with a slight lag period. But the agrochem business might get affected by raw material price volatility. In the AR the management has categorically mentioned about them being vigilant on the sourcing and accumulation of raw materials. I think crude going down and rupee weakening balance each other out. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: shadows

Date Posted: 26/Sep/2011 at 12:31pm

hitbhai should we use any stop loss for this stock.. as this semms to correcting a bit now

|

Posted By: Koti_gunda

Date Posted: 24/Oct/2011 at 7:45pm

|

PI Industries Quarter Results on Nov 5.

http://www.nseindia.com/marketinfo/companyinfo/online/corp_meeting.jsp?company=PI+Industries+Limited&bmdate=05-NOV-2011&desc=Un-audited+Financial+Results&tstamp=241020111100&seq_id=83216&symbol=PIIND - http://www.nseindia.com/marketinfo/companyinfo/online/corp_meeting.jsp?company=PI+Industries+Limited&bmdate=05-NOV-2011&desc=Un-audited+Financial+Results&tstamp=241020111100&seq_id=83216&symbol=PIIND &

|

Posted By: Koti_gunda

Date Posted: 24/Oct/2011 at 8:14pm

|

Traditinally, Q2 is the best quarter for the company & it is expected to do well.

The Custom Synthesis business should do well for the company as the commercialisation for 4 molecules has already started in the 2nd half of the last year and it is already visible in the 1Q2012. Moreover, Custom Synthesis hasn't grown well in 2Q2011, so the result will be comared with low base.

The Agri business also should do well because of good monsoon. Rallis had grown it's topline at 18%, but it had problems in maintaining the margins, because of this the bottonline hasn't grown well. In the last concall PI management told it don't see any problems in maintaining the margins as most of it's products are either #1 or #2 in their category. This can be seen closely for this quarter. If management keeps their word, then the agri business should do really well.

In 1Q2011, the comapny had polymer business which was sold out recently.

So this quarter there will not be any Polymer business sales, the agri & custom synthesis business should compensate the Polymer business also.

As the company is in the verge of rerating, this quarter results will be vital for that to happen.

Views invited.

|

Posted By: FutureBull

Date Posted: 01/Nov/2011 at 10:04am

|

Why is it so weak ahead of Q2 results? every rise is being sold into? ------------- ‘The market always does what it’s supposed to — BUT NEVER WHEN’. |

Posted By: master

Date Posted: 02/Nov/2011 at 11:52pm

I think there is overhang of Rallis that posted below average results with decline in EBIDTA > 20% y-0-y, markedly higher input cost and flat PAT.

Delay in sowing of key crops and uneven monsoon is another factor, though PI has other segments as well that may not be impacted much. ------------- Someone’s sitting in shade today because someone planted a tree long time ago. |

Posted By: FutureBull

Date Posted: 04/Nov/2011 at 12:14pm

|

Thanks Master, another reason I identified was very bad results by SONY and guidance was disaster too. market might be sensing some trouble about JV with SONY ------------- ‘The market always does what it’s supposed to — BUT NEVER WHEN’. |

Posted By: Koti_gunda

Date Posted: 05/Nov/2011 at 1:27pm

The SONY JV is just started. Till FY13 we can't expect any significant contribution from the JV. Till then company has to depend on its Agri & CSM business. |

Posted By: shadows

Date Posted: 05/Nov/2011 at 7:10am

results are not impressive

diluted standalone EPS at 7.7 vs 7.9 and net profit just 19.3 vs 18.7 crores. interim dividend at 2 rs. only [0.3% yield] waiting for the experts to comment on the results

|

Posted By: rapidriser

Date Posted: 05/Nov/2011 at 7:43am

The market had smelt the poor results in advance, Stock has been week the whole of last week. ------------- When all else is lost, the future still remains. - Christian Nestell Bovée |

Posted By: FutureBull

Date Posted: 05/Nov/2011 at 10:08am

|

While sales up by 33% but raw material costs, other expenditure inventory up by 50%. EBIT margin came down from 15.7% to 13.5%. We were supposed to see expansion here on account sale of low margin polymer biz.

I can only say that insiders were aware of weak or not so impressive results. Looking at the float/holding pattern it is hard to imagine that retail investors were selling. Del % was rather high with high volumes suggest institutions were selling and we forget the impeccable timing of Standard Chartered to reduce stakes. ------------- ‘The market always does what it’s supposed to — BUT NEVER WHEN’. |

Posted By: subu76

Date Posted: 05/Nov/2011 at 11:55am

|

When did they reduce their stake? These things seem to have become a pattern

|

Posted By: FutureBull

Date Posted: 05/Nov/2011 at 11:57am

|

I think over last 2 quarters ------------- ‘The market always does what it’s supposed to — BUT NEVER WHEN’. |