Balaji Amines

Printed From: The Equity Desk

Category: Investment Ideas - Creating winning portfolios!

Forum Name: Stock Synopsis

Forum Discription: A bried discussion of companies on very specific matters. Normally this is the prelude for further research as always members would be discussing quality companies with good management only

URL: http://www.theequitydesk.com/forum/forum_posts.asp?TID=2980

Printed Date: 06/May/2025 at 10:45pm

Topic: Balaji Amines

Posted By: abhishekbasu

Subject: Balaji Amines

Date Posted: 11/Sep/2010 at 1:54pm

I am in the process of studying Balaji Amines in greater details. Here are some of my thoughts.

Also, their R&D costs are capitalized to a large extent (rather than expensed) which has the possibility of raising the PAT. But realistically, the impact is not very significant as of now. Historically the debt-equity ratio has been over 1, although it is reducing a bit now, which is another red flag. But they seem to be doing well. I am expecting a yoy PAT growth of around 25-30% this year. Long term it may revert to its mean of 20%. I am expecting an EPS of around 38-40 this year, so at a PE of 8-10, my expected target is around 310-380, which is a significant upside from the current level (220-230). Senior TEDdies may want to look at the company and provide their views/feedback. Disc: I hold the stock ------------- |

Replies:

Posted By: shivkumar

Date Posted: 11/Sep/2010 at 5:22pm

|

I understand that Balaji Greentech is coming out with an IPO in which Balaji Amines could offload some of its equity holdings. No time frame has been given for this. Regarding the hotel project, the management is optimistic about the business in which Rs 30 cr is to be invested mainly by way commercial borrowing. I have been given to understand by the management that the hotel is coming up on a plot of land owned by the company. Solapur town is lacking in good hotels and management expects good potential as a number of corporate houses are setting up facilities here. Moreover, there are no immediate plans for new hotels by any major player, so Balaji Amines could enjoy some pricing power on its hotel project for some time. |

Posted By: abhishekbasu

Date Posted: 11/Sep/2010 at 6:45pm

|

The total hotel project cost is 40 crores as per their AR. And you are right, the land is part of their old office building on the main central road in Solapur. Business wise it may do well as Solapur is developing well as a industrial town, but I am not too sure what synergies are there between running a chemical company and owning a hotel. Seems more like a distraction to me.

------------- |

Posted By: shivkumar

Date Posted: 11/Sep/2010 at 11:45am

| Absolutely no synergies. but it is better to build a good quality hotel which has the potential to be sold to a hotel chain some years down the line rather than sell the land to some builder. |

Posted By: nav_1996

Date Posted: 12/Sep/2010 at 5:30pm

| When you are a reasonably large company in a small town and accomodation available in the town is not good enough for your customers you have to develop good guest houses anyway. So that may be another possible angle for hotel. |

Posted By: excel_monkey

Date Posted: 06/Jan/2011 at 3:37am

|

key raw material Methanol prices are up

margins could fall going forward I don't know much about the company but capacity utilization and capacity addition could help bridge the gap at net profit level |

Posted By: CHINKI

Date Posted: 06/Jan/2011 at 7:06am

|

Few months back, they have already increased the prices. I don't know how much they could do now?

Where did you get to know about the increase in Methanol Prices?? If there is any link, let me know. Trail run for the additional capacity of NMP is going on. It should be through in another a week or 10 days. ------------- TOUGH TIMES NEVER LAST, BUT TOUGH PEOPLE DO |

Posted By: excel_monkey

Date Posted: 06/Jan/2011 at 8:06am

well one of my friend who is a petchem analyst

|

Posted By: excel_monkey

Date Posted: 16/Jan/2011 at 9:15pm

|

Even though this one has been a consistent performer in terms of financials

I am not sure if this company can be called as a specialty chemicals company and why do they publicise that methylamine and ethyl-amine are some sought of complex products when these molecules have been around for decades it is a small company which could be just wiped out because some Chinese chemicals giants decides to ramp up it amines capacity which Balaji produces and remember Chinese have cheap debt, cheaper capital and free infrastructure Chinese don't care about the ROE they want scale I would be wary of 1-2 product companies |

Posted By: CHINKI

Date Posted: 16/Jan/2011 at 7:52am

|

I don't know how much you know about this company or whether you have visited this company.

First of all, it is not just two products company. It sells more than 25 products. Many of their products can not be manufactured by others due to the technology. The best part of this company is that they have developed this inhouse and they produce it in large scale. Most of the products which they have introduced off late are all import substituted products. So you imagine none of the so call big Indian Chemical Companies does not or do not have technology to do so. As far as the Chinese imports are concerned, they are good at producing anything in large quantities where quality and technology are not involved. ------------- TOUGH TIMES NEVER LAST, BUT TOUGH PEOPLE DO |

Posted By: excel_monkey

Date Posted: 17/Jan/2011 at 1:10pm

|

I would not derate Chinese

they are far far ahead of Indians when it comes to innovation and manufacturing just search for BDY where WB is invested all I am saying is if a Chinese producer decides to manufacture the products Balaji is manufacturing and we would be all done with the company |

Posted By: abhishekbasu

Date Posted: 17/Jan/2011 at 2:09pm

Well, I would not be so sure as well. Like Indian companies, Chinese companies cannot be also painted by one single brush. I have personally done business consulting for multiple companies in China and my experience is that they also have their own set of issues and challenges. What gets highlighted in the Western media is what the media believes the people want to hear. So, I am not so ready to believe that "some" Chinese company will come and destroy the market for Balaji (or any Indian company for that matter). P.S. BYD has not been doing well lately. Its annual growth last year was at 15.5% which is lower than the 32% that the overall Chinese auto makers grew. The company estimates to grow at 10% this year and admits publicly that it needs to improve its product quality. --- ref: Asian Wall Street Journal ------------- |

Posted By: sbkv

Date Posted: 17/Jan/2011 at 3:55pm

Hmm does this imply CHINKI has visited the plant/management? Could you plz provide some feedback on Management. If prospects are so bullish why has management reduced stake recently? What makes me worry is everyone and his uncle has come out with recommendations on this one ( SP Tulsian, Ashish Chug,etc....) while promoters have reduced stake! |

Posted By: CHINKI

Date Posted: 17/Jan/2011 at 6:44pm

|

That has happened during second quarter (40,000 shares).

While I donot know the exact reason, my guess could be, Chairman's son has returned from US. Instead of handing over the company on a platter, they wanted him to do something on his own. There was a proposal to start a new factory adjacent to Balaji Amines Factory. I presume, sale may be for that. We can get the details after their results are out. ------------- TOUGH TIMES NEVER LAST, BUT TOUGH PEOPLE DO |

Posted By: excel_monkey

Date Posted: 17/Jan/2011 at 7:45pm

|

Just checked methanol (a key raw material of balaji) has jumped from 290 to 390

Now at 350 Margins would be poor this quarter |

Posted By: CHINKI

Date Posted: 17/Jan/2011 at 8:02pm

|

Increase in raw material prices would definitely have an effect on their margins.

While they have passed on the increase in RM partially to their customers plus the increase in high margin products should offset that impact to some extent. ------------- TOUGH TIMES NEVER LAST, BUT TOUGH PEOPLE DO |

Posted By: excel_monkey

Date Posted: 17/Jan/2011 at 2:33am

|

Chinese have already starting dumping Balaji's products

http://www.livemint.com/2010/12/13185348/Govt-starts-chemical-dumping-p.html Govt starts chemical dumping probe from China, EU, US New Delhi: The Government has initiated a probe into alleged dumping of morpholine - a chemical used in crop protection and rubber industry - by exporters from the EU, US and China in the Indian markets. The Directorate General of Anti-Dumping and Allied Duties in the Ministry of Commerce and Industries started the investigations on a complaint by Maharashtra-based Balaji Amines Ltd last week. The DGAD said it has “sufficient evidence” of dumping of the chemical from the EU, US and China. “The Authority (DGAD) hereby initiates an investigation into the alleged dumping, and consequent injury to the domestic industry...,” it said. Morpholine is an extremely versatile chemical and is used by rubber industry and drugs industries. It is also used in crop protection agents, dyes and optical brighteners. Besides, it is also an important chemical for the toiletry and cosmetic products manufactures. The probe would look into the imports between July 2009 and June 2010. On the recommendation of the DGAD, the Revenue Department imposes anti-dumping duty. India has slapped the restrictive duty on several items such as yarn, fabrics, certain stainless steel products, auto parts and chemicals imported from various countries. A country initiates anti-dumping probe to see whether its domestic industry has been hurt due to a surge in below-cost imports. As a counter-measure, it imposes duties under the multilateral regime of the WTO. Such duties ensure fair trading practices and create level-playing field for domestic producers vis-a-vis foreign players resorting to dumping. |

Posted By: CHINKI

Date Posted: 17/Jan/2011 at 7:13am

|

Thanks Excelji for the info and link.

They have sold hardly 990MT compared to 683MT of last year till September. They have a capacity of 3000MTPA and the quantity clearly shows that they are unable to use the full capacity. Also their rate/MT of Morpholine is coming down showing that there must be competition for this product. ------------- TOUGH TIMES NEVER LAST, BUT TOUGH PEOPLE DO |

Posted By: shivkumar

Date Posted: 17/Jan/2011 at 10:08am

That is a 50 per cent increase in sales. Excess capacity means there won't be capex for the next couple of years on this product. However pricing pressure is cause for concern. |

Posted By: CHINKI

Date Posted: 17/Jan/2011 at 11:19am

|

For most of the products they have good capacities which does not require any more further capex.

Also in most of the chemical industries, by removing some bottlenecks, capacities can be increased by 30%. ------------- TOUGH TIMES NEVER LAST, BUT TOUGH PEOPLE DO |

Posted By: hit2710

Date Posted: 10/Feb/2011 at 4:36pm

|

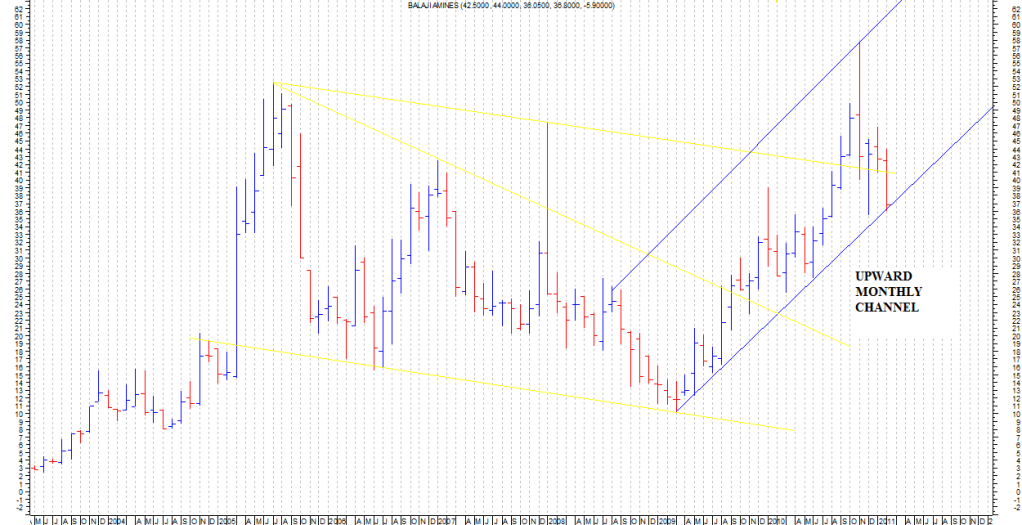

Balaji amines has reported around 50% jump in net profits for 9m fy 11. 9M eps is around 7.7. Full year EPS for fy 11 could be around 10.

Looking at the charts on a monthly basis, the stock seems to be taking support at the lower end of an upward sloping channel. The stock had earlier formed a bottom of 35.5 in dec 2010 and has recently posted a bottom of 36.05 in Feb 2011. If it holds and stock moves above around 45-46 then there will be a confirmation of a double bottom with targets in excess of 60. Crucial support to be watched should be 35-36. cmp around 36.80  ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: values

Date Posted: 10/Feb/2011 at 4:40pm

is the chart from equis metastock ? ------------- Knowledge is power! |

Posted By: hit2710

Date Posted: 05/Mar/2011 at 6:57pm

Balaji Amines gave a good move on Friday and closed around 45, having posted a high of around 48.90. It seems the double bottom is now firmly in place and Balaji now becomes a good stock to buy on declines. 200 dema is placed around 39.65. This looks like a good combination of fundamentals with strength shown on charts also. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: hit2710

Date Posted: 07/Apr/2011 at 6:54pm

Earlier I had mentioned a low risk entry point in balaji amines at around 37 based on monthly channel. Stock has today hit a high of around 52 and looks like heading towards upper end of channel which gives targets of 60 plus levels.

------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: abhishekbasu

Date Posted: 29/Jul/2011 at 4:03pm

|

Balaji Amines had a conference call on July 28, 2011. Here are the key takeaways from it:-

------------- |

Posted By: excel_monkey

Date Posted: 29/Jul/2011 at 5:07pm

Last 3 weeks methanol is up 10% from 340 to 370 $ per ton ------------- I have a vested interest in the stocks I discuss, therefore I would request you to kindly consider my comments with a pinch of salt and do your own due diligence |

Posted By: vaib

Date Posted: 29/Jul/2011 at 10:46pm

| thanks abhishek ji for the updates. |

Posted By: shontou

Date Posted: 07/Nov/2011 at 9:25am

|

Conference Call

Balaji Amines Setting up a new project for manufacturing Methyl Amines (100 tonnes pd), Dimethyl Formamide (70 tonnes pd) and Dimethylamine Hydrochloride (36 tonnes pd) Balaji Amines held a conference call on 4 November 2011 for discussing the results for the quarter ended September 2011. Mr. D. Ram Reddy, Director addressed the call. Conference Cal Highlights Despite the depression in European markets, Balaji Amines performed well during the half year ended September 2011. It recorded net sales of Rs218.69 crore for the half year ended 30 September 2011. Net Sales increased by around 28.53% for the period over the previous years' first half of Rs 170.14 crore Profit after Tax increased by around 10 % over previous half years' Rs 16.21 crore to Rs 17.79 crore for the current year's first half. Exports during the period ending 30 September 2011 have gone up by 31% from Rs 41.63 crore of previous year 2010-11 to Rs 54.58 crore for first half year during current year 2011-12. Net profit of Balaji Amines improved 6.41% to Rs 10.63 crore during the quarter ended September 2011 as against Rs 9.99 crore during the previous quarter ended September 2010. Sales rose 14.18% to Rs 104.17 crore in the quarter ended September 2011 as against Rs 91.23 crore during the previous quarter ended September 2010. The company is setting up a new project for manufacturing Methyl Amines for a capacity of 100 tonnes per day, Dimethyl Formamide for a capacity of 70 tonnes per day and Dimethylamine Hydrochloride for a capacity of 36 tonnes per day. The cost of the project is Rs 60 crore and work on the project is under execution. Of the total cost of the project, Rs 40 crore has been funded through debt from State Bank of India and the rest from internal accruals. Methyl Amines, product would be manufactured from January 2012, Dimethyl Formamide from April 2012 and Dimethylamine Hydrochloride from June / July 2012. The total revenue from the new projects along with the already existing capacity would grow up by another Rs 900 crore. The consumption of Dimethyl Formamide is 30000 tonnes per annum in India. The company along with other projects, is also setting up a Five Star Hotel at Solapur in Maharashtra with a capacity of 100 room. The cost of the project is Rs 55 crore, of which Rs 30 crore to Rs 40 crore has already been spent. The cost of the project has gone up from its earlier estimates of Rs 40 crore. The hotel is being constructed on the company's own land. The project is expected to be completed by June 2012, however the company is confident that it would commission it in December 2011. The project is an eco friendly project. A formal agreement with SAROVAR Group of Hotels has been entered for operating / managing the Hotel property in the name of BALAJI SAROVAR PREMIER. Drug Master File applications have been successfully filed both with US FDA and EU Authorities for its new product Pharmapure Povidone (Polyvinyl Pyrrolidone K-30). ------------- Every day, self-proclaimed stock market "experts" tell us why the market just went up or down, as if they really knew. So where were they yesterday? |

Posted By: abhishekbasu

Date Posted: 25/Nov/2011 at 5:04pm

|

Balaji Amines announced a 70cr expansion plan of its Solapur plant. The company is planning to add 33,000 TPA to its existing 22,000 TPA capacity.

Stock up over 10%. http://www.moneycontrol.com/news/business/balaji-amines-plans-rs-70cr-capacity-expansion_624398.html ------------- |

Posted By: abhishekbasu

Date Posted: 31/Jan/2012 at 4:15pm

Decent results from Balaji Amines...

------------- |